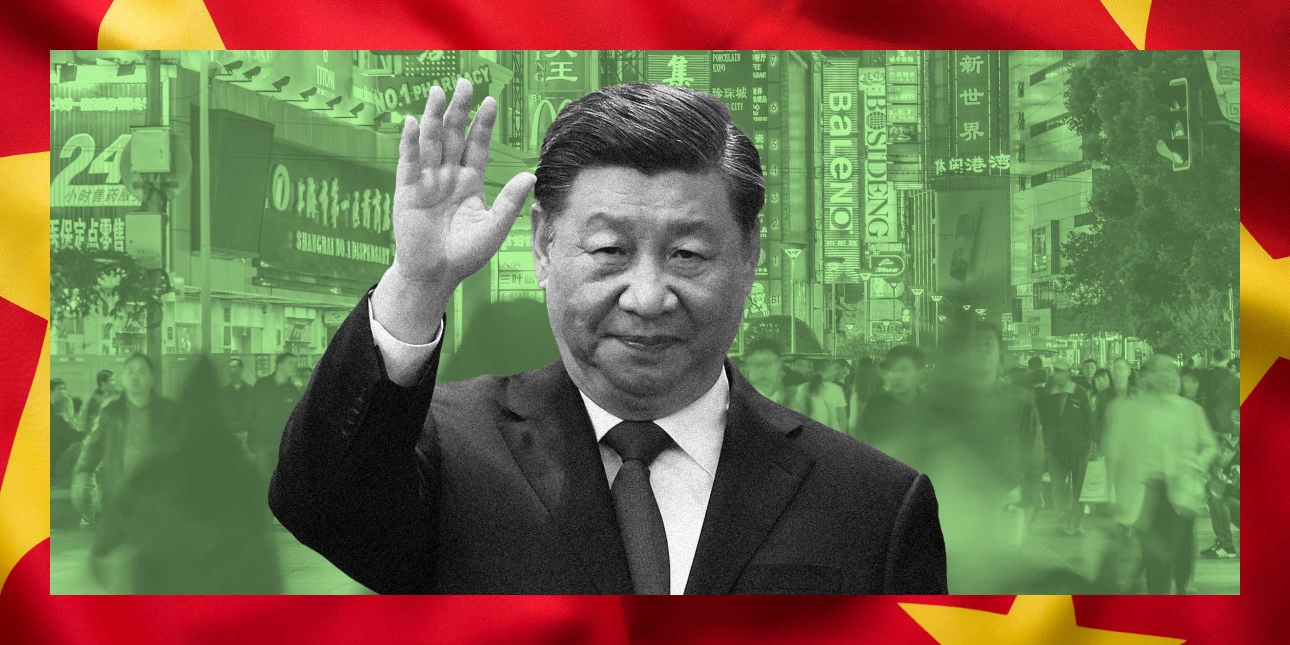

Shanghai Surprise

China is reopening to the world after its fight against Covid-19, and the rewards of getting in early are obvious. But that doesn't mean there aren't storm clouds breaking into the sunlit uplands, says City AM editor, Andy Silvester.

What a difference a couple of months makes. In October of last year, the eyes of the world turned to extraordinary palace intrigue live on Chinese state TV, with the former president Hu Jintao escorted out of the Communist Party's Congress by two rather heavy-handed party officials. The world stood baffled, too, by China's zero-Covid policy - which seemed destined to ensure that the once-roaring Chinese economy would struggle to kick into high gear even as the rest of the world left the pandemic behind. Protests against the regime were more prevalent than they had been at any point since the Tiananmen Square massacre.

And yet here we are just after Chinese new year and the mood music could not be more different. The country ditched its zero-Covid policy with extraordinary speed, and the country which retreated back behind the metaphoric and literal walls of the Forbidden City is once again out on the world stage. Liu He, a trusted adviser to Chinese premier Xi Jinping, was quoted by the Economist as telling reporters that his welcome at Davos, the gathering of the great and good of the political and business world, was fulsome.

"China's national reality," he said, "dictates that opening up to the world is a must, not an expedience. We must open up wider and make it work better," Liu said.

So is it all systems go for western firms looking to get back into the Chinese market? There's plenty to be optimistic about - from a growing middle class and a seemingly more inclined to listen regime. Yet two issues remain: an increasing willingness of western governments to put trade ties at risk on national security grounds, Beijing's threatening behaviour towards Taiwan and it's closeness to Russia.

LOSING SIGNAL

US President Joe Biden doesn't share much with his predecessor Donald Trump. A preponderance to take classified documents home is one - but the other more relevant meeting of minds is an increasingly bellicose attitude towards Chinese trade ties. Both have moved harder and faster than many expected in tackling everything from Chinese tech firms to metals dumping - and their belligerence has given cover for other countries to follow suit.

The most obvious, in fact, is right here at home. The last few years have seen a gradual removal of Chinese influence in the British infrastructure economy, starting with the removal of Huawei from the 5G network and continuing through the government blocking the takeover of Newport Wafer Fab, the country's most prolific semi-conductor factory, by a Chinese-linked Dutch firm.

How much of this affects the day-to-day operations of most businesses with links to China is up for debate. Frosty relations at political level do not mean much down the chain. But there are other reasons for nervousness about doing business in China, or representing Chinese firms' interests here.

THE ASIAN TIGER BARES ITS TEETH

The speed with which British businesses bailed out of their Russian links at the start of last year after the Kremlin's invasion of Ukraine should give pause to those pursuing closer links with Beijing.

Increasingly, the eyes of geopolitical forecasters are turning to Taiwan. The history of China's post-war ‘divorce' from the island a hundred miles or so off its coast is fascinating, but suffice it to say that Beijing believes the unruly island belongs to it - and Taiwan's government has never in reality recognised Beijing's authority over the mainland. In the past few decades, Taiwan has gone from a one-party state to one of the world's most successful multi-party democracies and has a thriving future-proofed economy. It also is in Xi Jingping's crosshairs.

"An overnight pulling out with trading partner China would make our existing non-energy links with Russia look like chickenfeed"

Would China dare invade? Certainly the regular buzzing of Taiwanese airspace by Chinese forces, and the latter's naval manoeuvres off its coast, suggests Jinping is in no great hurry to swat away that fear. The US, despite Joe Biden's occasionally off-message remarks, has never fully promised to step in if Taiwan was invaded. Hawks who reportedly have Jinping's ear are also pushing for more aggression towards what it sees as a tearaway teenager.

But, but, but. Russia's botched invasion of Ukraine suggests that even the most over-matched military can put up an almighty fight if the public are willing to chip in. Meanwhile, British businesses will need to make their own call about the risk of a full-scale Chinese invasion of Taiwan - and whether that would, as it surely must do, presage an overnight pulling out of a trading partner that would make our existing non-energy links with Russia look like chickenfeed.

RISK / REWARD

Laid against this negative take are the opportunities. A thriving and growing middle class wants top-class professional services, from banking to software - and Britain happens to be exceptionally good at both. Larger businesses want legal protection and consultancy, another key point of difference for UK firms. Our private and university education systems are already closely aligned. And it is also true that there remains a Sinophobic note to the discourse around China's machinations on the global stage.

"The upshot for any British firm in China: go in with your eyes wide open"

The upshot for any British firm in China? Go in with your eyes wide open. And for PR firms, the ability to move quickly and see which way the wind is blowing may be as valuable for their own reputation as their clients.

.jpg&w=728&h=90&maxW=&maxH=&zc=1)